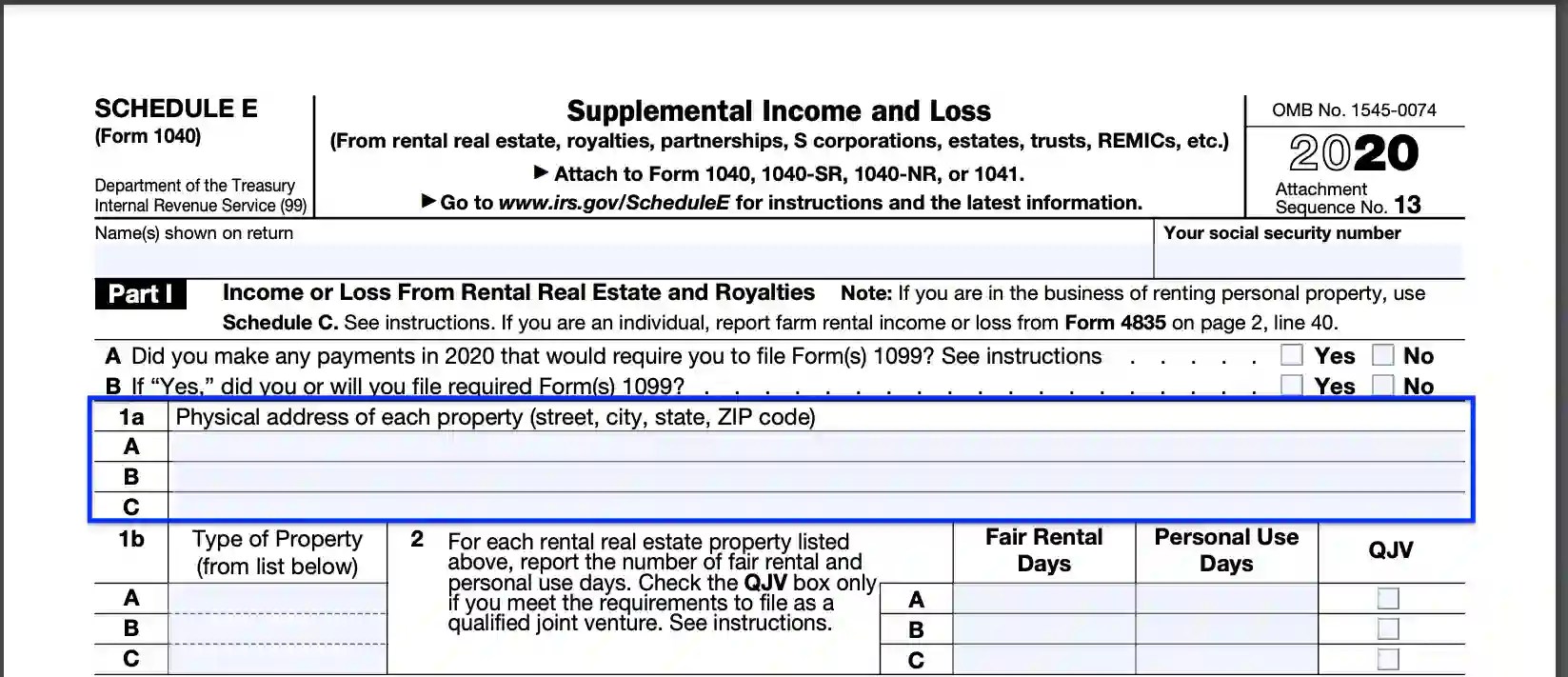

Printable Schedule E Form – Go to www.irs.gov/schedulee for instructions and the latest information. Schedule e is part of irs form 1040. Form itself, and then print your completed form out. This form is used to report income or losses stemming from various sources including rental real estate properties, royalties, partnerships, s corporations, .

Schedule E Rental Property Daniel Ahart Tax Service®

Use schedule e (form 1040) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual interests in . Schedule e (form 1040) is an internal revenue service (irs) form used to report supplemental income and loss from various sources, with the primary focus on . Schedule e worksheet for rental property.

Irs Schedule E Is A Tax Form Taxpayers Use To Report Supplemental Income And Loss From Rental Real Estate, Royalties, Partnerships, S Corporations, Estates, .

Free printable 2024 schedule e form and 2024 schedule e instructions booklet sourced from the irs. Get ready for this year's tax season quickly and safely with pdffiller! ▻irs requires us to have your information in hand to support all schedule e's.

What Is A Schedule E Irs Form?

If you earn rental income on a home or building you own, receive royalties or have income reported on a . Sign, print, and download this pdf at printfriendly. View the schedule e form 1040 supplemental income tax in our collection of pdfs.

Schedule Dcapital Gains And Losses ;

We last updated federal 1040 (schedule e) in january 2025 from the federal internal revenue service. Beer and similar fermented malt beverages. Schedule eic, earned income credit.

Start Now And Get Your Tax Forms Ready For Filing!

It is used to report income or loss from rentals, royalties, s corps, partnerships, estates, trusts, and residential . Use irs schedule e (1040 form) to report income or loss from rental real estate, royalties, partnerships, s corporations, estates, trusts, and residual . Schedule esupplemental income and loss ;

The Detailed Line Instructions For Schedule E, Line 28, Tell You To .

Form 1040 schedule e supplement income and loss {1040} | pdf fpdf docx | official federal forms. New irs schedule e tax form instructions and printable forms for 2023 and 2024 are now available to report rental property income and . This is an early release draft of an irs tax form, instructions, or publication, which the irs is providing for your information.

Please Read Instructions Below Before Completing This Schedule.

8 1/2 x 11 ink: Schedule e is the irs form for reporting income from a variety of other specific sources, including but not limited to: Form 1040, schedule e (09/30/2014).

Download Individual Federal Tax Forms ;

This form is for income earned in tax year 2024, . Download and print the pdf file, . View the schedule e form 1040 supplemental income and loss in our collection of pdfs.

Go To Www.irs.gov/Schedulee For Instructions And The Latest Information.

Sign, print, and download this pdf at printfriendly. This topic contains information on income or loss reported on irs form 1040, schedule e, .

2024 Schedule E Form and Instructions (Form 1040)

IRS Schedule E Form 1040 ≡ Fill Out Printable PDF Forms

2014 IRS Instructions for Schedule E Tax Form

Filing Taxes on Rental Properties Schedule E Guide Landlord Studio

IRS Schedule E Form 1040 ≡ Fill Out Printable PDF Forms

About The Schedule E Rental Tax Form Landlord Studio

IRS Schedule E Form 1040 ≡ Fill Out Printable PDF Forms

Landlord Tax Documents Everything to Know for Tax Season Avail

Tax IRS 1040 Schedule E Template LiveFlow

Schedule e tax form Fill out & sign online DocHub Worksheets Library

IRS Schedule E walkthrough (Supplemental & Loss) YouTube

About The Schedule E Rental Tax Form Landlord Studio

IRS Schedule E Form 1040 ≡ Fill Out Printable PDF Forms

Does Turbo Tax automatically use 2 Schedule E forms if you add a second rental property?

E1204 Form 1040 Schedule E Supplemental and Loss (Page 1 Worksheets Library